An in-depth analysis of our data

11 juli 2024, PaulAt our Experience Store in Doesburg, and not at the Ligier store, we mainly sell used cars from Lynk & Co and the cars traded in. Selling used cars is significantly easier than selling mopeds. For mopeds, the effect of portals like Autoscout24 or Autotrack is minimal, and only Marktplaats has some impact, although limited.

Selling used cars is significantly easier than selling mopeds.

For used cars, you actually only need the portals, and your own website as a car company is of secondary importance. First, you advertise on the portals, and if the lead comes to your own website, you have the best chance. But who knows that our website is called experiencestoredoesburg.nl?

Advertising

We advertise on Marktplaats, viaBOVAG.nl, AutoScout24, and AutoTrack. We pay a price we have negotiated. With Marktplaats, this goes better thanks to my ambassadorship, and also with Autotrack. We get an introductory discount at Autoscout24 and pay only per lead at ViaBOVAG. Later in this article, I will calculate the Cost per Sale per portal.

First six months

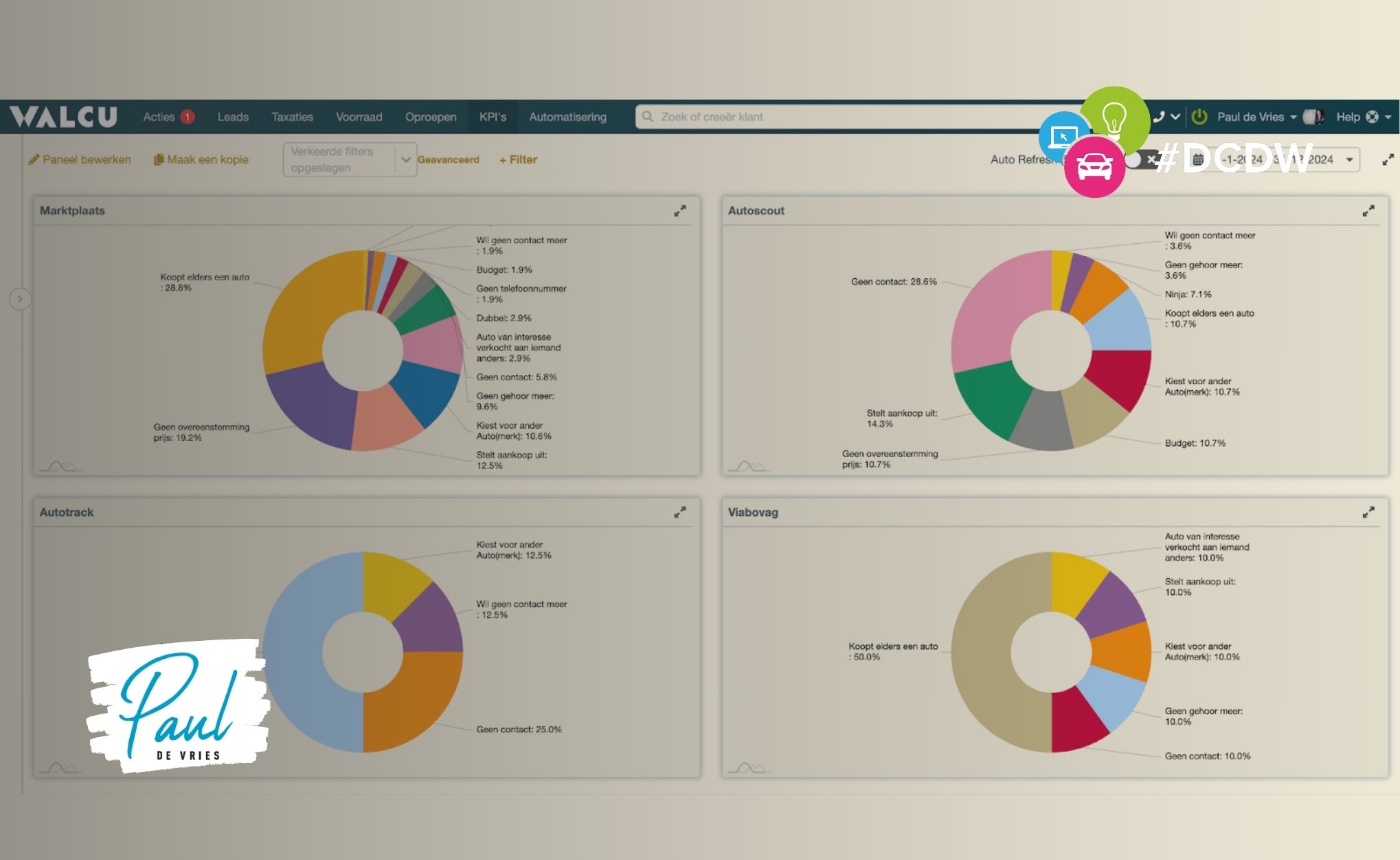

If you look at this statistic, you will see four pie charts of the four portals. What has been sold, and what has not? We do not consider leads still in process here. So, leads in the first half-year can still result in sales.

You see that Marktplaats has a conversion rate of 11.6% from lead to sale, while Autoscout24 has the highest conversion rate at 17.1%. Autotrack has a conversion rate of 11.1%, and ViaBOVAG 8.3%, which is the lowest.

It is just one number; I often say that one data point is not data. What else is behind that data, for example, the quantities associated with it?

- Marktplaats: 20 sales

- Autoscout24: 6 sales

- Autotrack: 1 sale

- ViaBOVAG: 1 sale

With the limited sales numbers from Autotrack and ViaBOVAG, you see that if you sell one extra car, the conversion percentage increases enormously. This is in contrast to Marktplaats, where one or two extra sales do not significantly impact the conversion percentages due to the higher numbers.

Can you conclude that leads from portal X are better than those from Y? No, because if we look at the reasons why we do not sell, you see the following:

You see that due to the large numbers at Marktplaats, there are many more different write-off reasons than at the others. For leads you cannot do anything with, such as ‘no contact’ or ‘ninja’, you see that each portal has leads in that category. Autoscout24 has many leads with ‘no contact’ at 26.6%. ViaBOVAG shows a high percentage of leads that ‘buy elsewhere’. These are high-quality leads on which we as a company have lost a sale. At Marktplaats, the largest part of the write-off reasons is ‘buys a car elsewhere’, which are also high-quality leads. (What is Ninja? A customer who could never buy, due to a guardian, BKR or really fake)

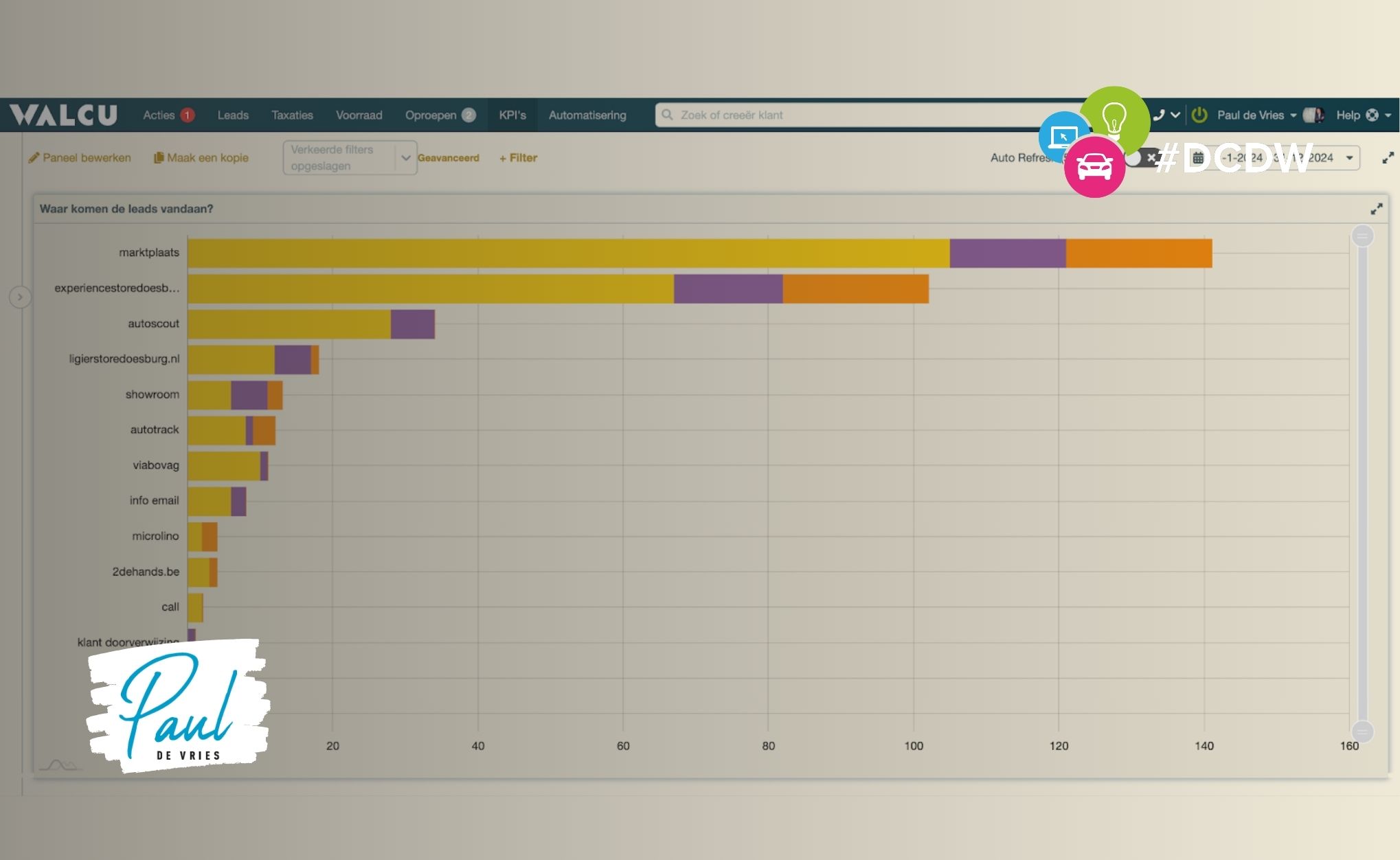

If we look at the numbers, we see the following list from Walcu:

Marktplaats provides by far the most leads, followed by Autoscout24 as a clear number two. Autotrack and ViaBOVAG are close. One data point, even if it is numbers, says nothing…

Own website

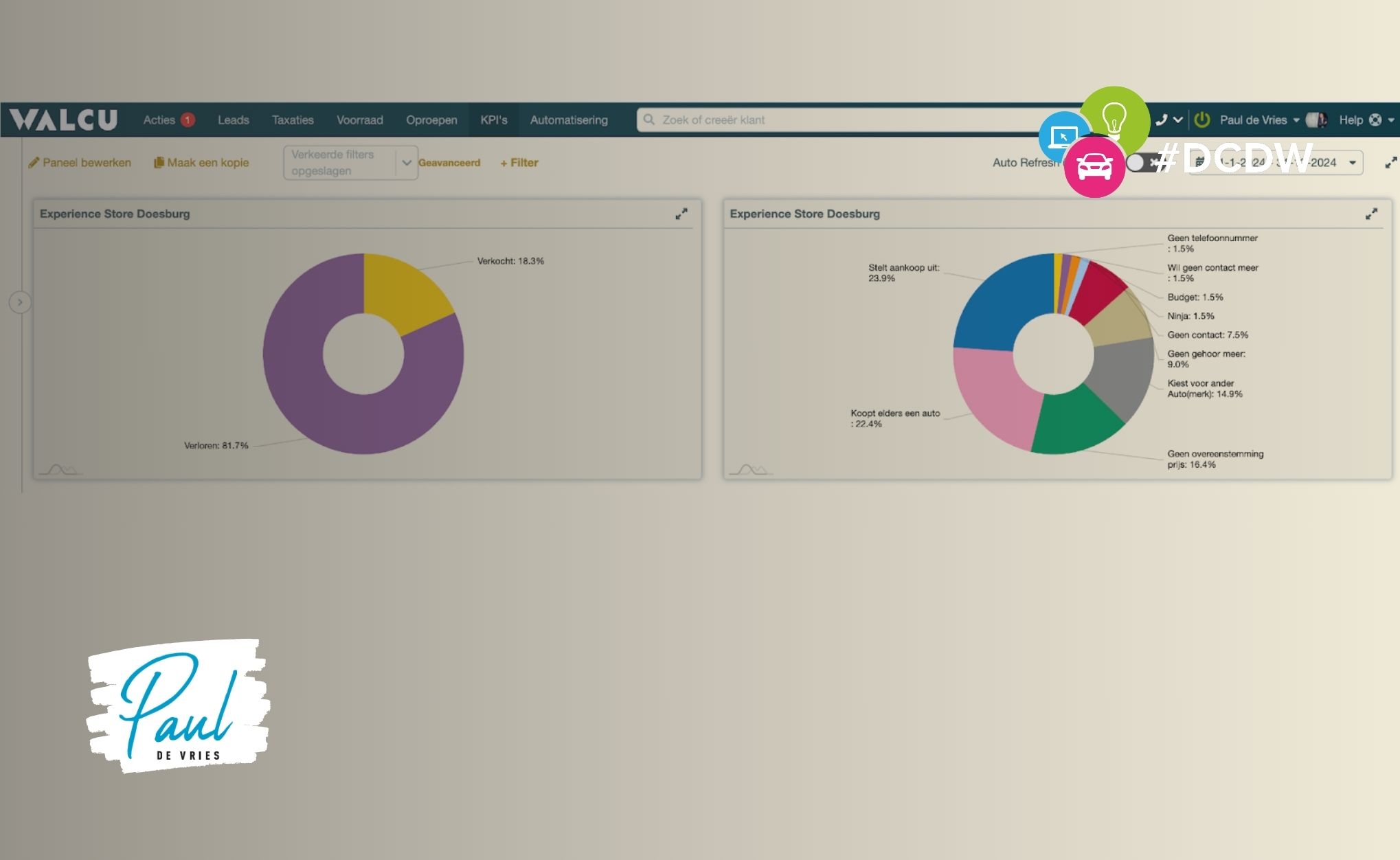

Looking at the same graph about our website, experiencestoredoesburg.nl, we see the following:

The conversion rate is 18.3%, with 15 sold orders, and the write-off reasons are of good quality. The big question is who ensured that the visitors came to the website?

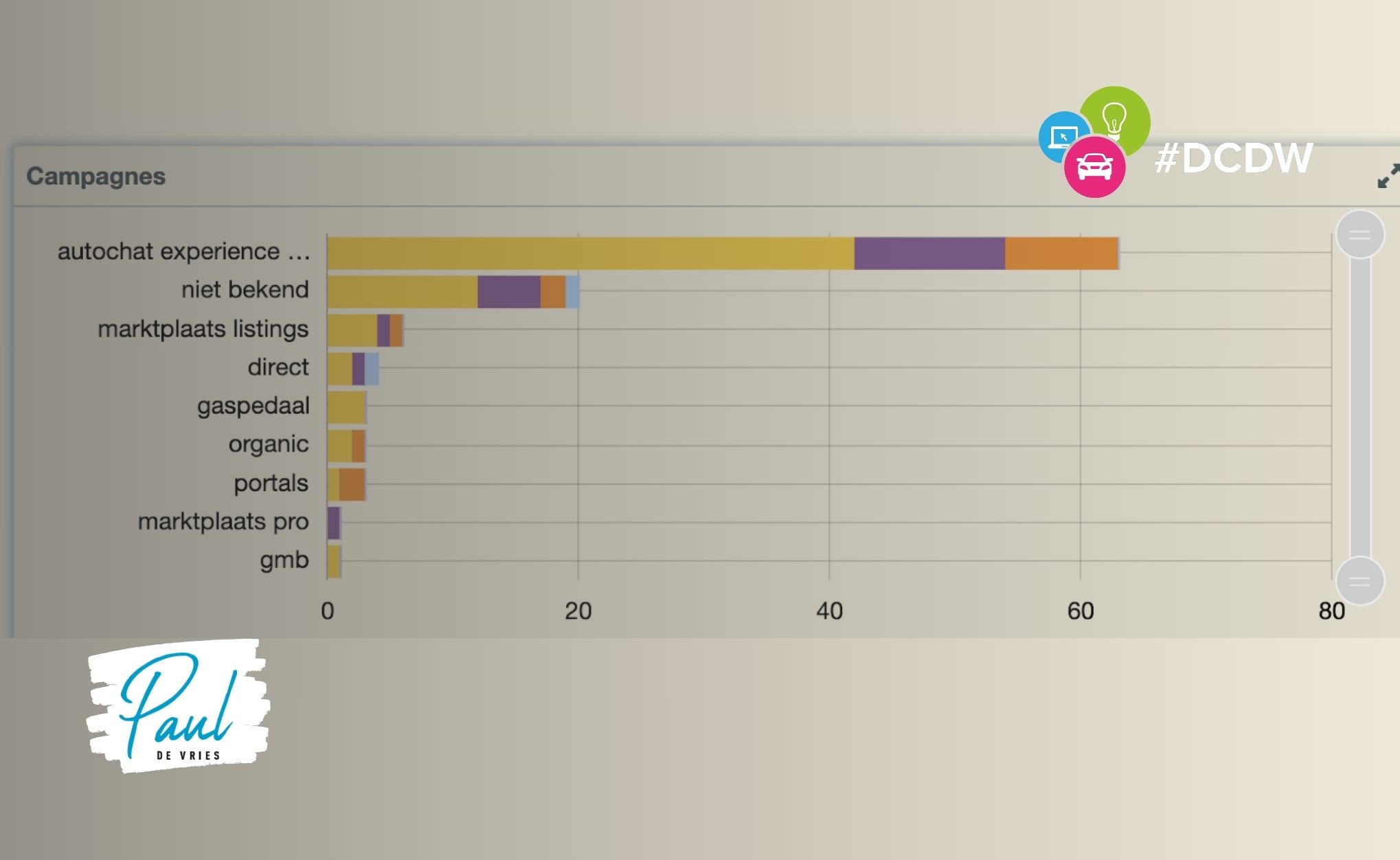

Here it appears that Marktplaats listings get the most URL visitors to the website with a concrete request or sale. AutoChat is the largest lead provider on the website, which is logical since it is our only Call to Action, and we have no forms on this website. (if you look at Google GA4, we see Marktplaats, Google CPC and Gaspedaal as the largest providers of qualified visitors who show engaged behavior)

If our website has the highest conversion rate, what does this mean for the portals? Without the portals, nothing happens. If people do not look at cars on websites like Marktplaats, they will never just visit a car company’s website in Doesburg. So visibility is absolutely necessary. Calculating a Cost per Sale for the own website is impossible because all marketing efforts ultimately lead to the website.

What you see is that visits via the portals, such as Marktplaats, Autotrack, and ViaBOVAG, can be considered the best visits for KPIs such as Time On Site and the number of pages visited. Autoscout24 does not count here because there is no URL click-through possibility, and you thereby close a very valuable channel.

Cost per lead and Cost per sale

Looking at the costs, we come to the following numbers:

- Marktplaats total costs: €5,061; number of leads: 136. This means a Cost per lead of €37.21, and with 15 sales, a Cost per Sale of €337.41.

- Autoscout24 total costs: €3,429; number of leads: 36. This means a Cost per lead of €95.25, and with 15 sales, a Cost per Sale of €571.50.

- Autotrack total costs: €600; number of leads: 100. This means a Cost per lead of €100, with 1 sale a Cost per Sale of €600.

- ViaBOVAG total costs: €591; number of leads: 11. This means a Cost per lead of €53.72, with 1 sale a Cost per Sale of €591.

Now this is not black and white! After all, for the visited pages at a portal, you can easily calculate 50% of the investment. The portal provides VDP pages, and if you are lucky, leads. The investment I make is first for the VDP pages. However, this is a way many dealers/car companies calculate. So here you see the cost at the front of a portal match with the ROI. Expensive or cheap have a comparable KPI. (Note: in the half-year, I have only included leads from Lynk and Co’s and not from other vehicles like an old Opel we also sold)

Big differences

The differences are big, but which amounts are important? Is the Cost per Sale the most important factor, while you know that the numbers of leads, and therefore chances, are lower at Autotrack and ViaBOVAG than at Autoscout24 and Marktplaats? Moreover, two extra orders have a huge positive impact on the current Cost per sale, while the numbers of sales are still minimal? So again, one data point is no data, whatever information you look at.

I have learned that in twelve months, I can start a universal car company from scratch, and only the portals are needed to ultimately become quite successful in retailing used cars, without people knowing you.

For the large dealer holdings at A1 locations, it may often seem that these portals are a superfluous luxury, but if you look deep into the numbers, and it doesn’t matter which data points you look at, the conclusion will always be the same: you cannot do without those portals. I can’t, the large dealer holdings can’t. And no, I wouldn’t actually exclude any at this point.