Wow, we are going from four to three portals (Marktplaats, Autotrack, and Viabovag)

19 december 2024, PaulDecember is a time for recalculating and reflecting: what went well, and what could be improved? At Ligier Store Doesburg – Experience Center, it’s no different. With access to the beta version of Google Vehicle Listing Ads (VLA), we must rethink our marketing strategy. Although the beta version is not yet optimal and generates few visitors and conversions, it holds potential. In the US and the UK, VLAs have proven impactful for active car dealers. The same could happen here—for those paying attention. I’m glad we’re in the beta, though we’re still waiting for results.

Budget Is finite!

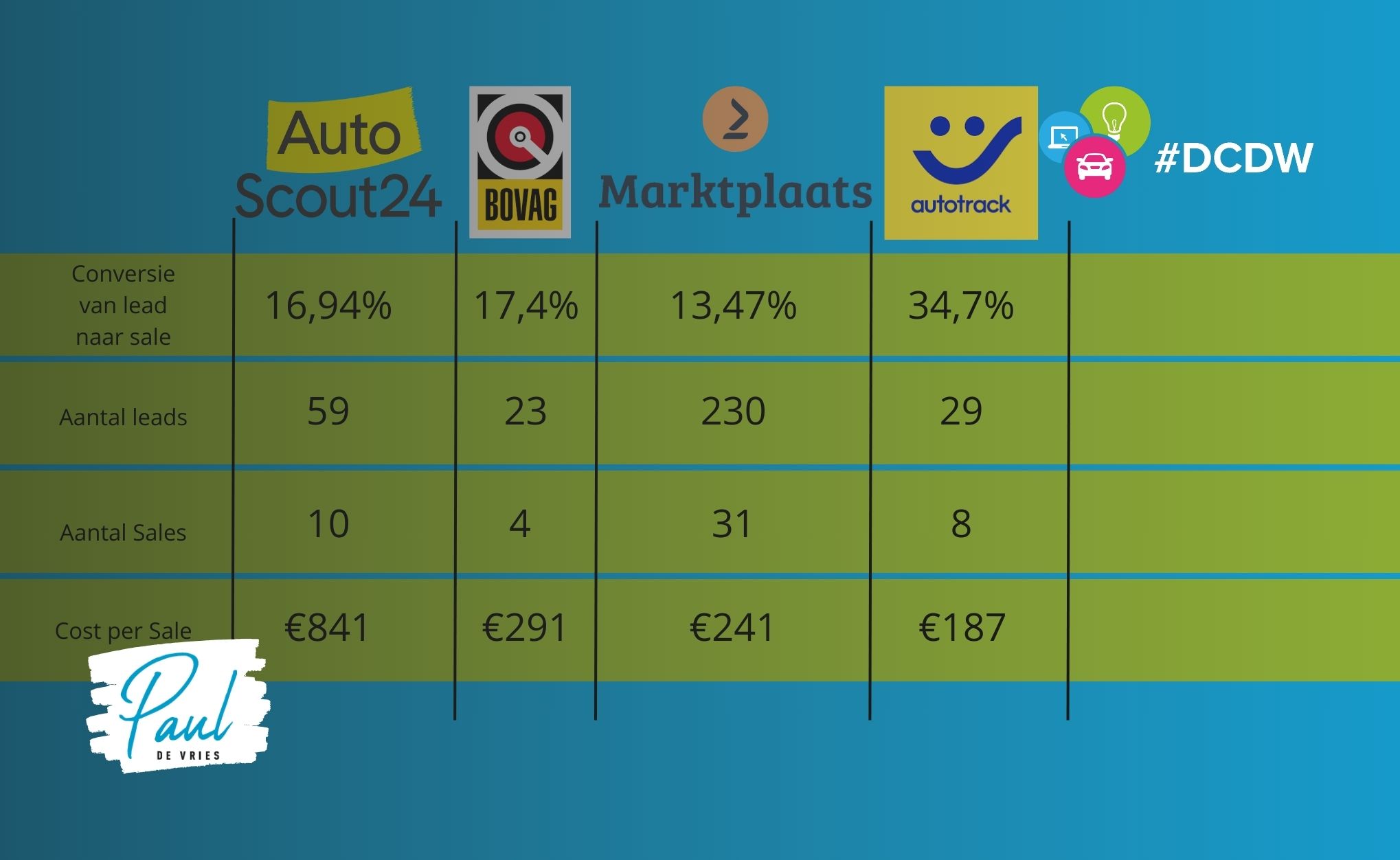

This means I either have to pay for the extra Google budget out of pocket or allocate it from our marketing budget, making cuts elsewhere. In my article on marketing data from Ligier Store Doesburg and what the portals do for us, it’s clear this expense must come from that budget. Perhaps we don’t need four portals? For microcars, that’s clear: only Marktplaats adds value. Autoscout24, Autotrack, and ViaBOVAG generate no traction for microcars, which is fine since they don’t target that market. They are true verticals focused on “used cars.”

Experience Store Doesburg

We also operate a ‘regular’ car dealership, Experience Store Doesburg, where we mainly sell used Lynk & Co cars. For these used cars, portals are very useful. Marktplaats, as a horizontal and the largest platform, reaches a unique customer base of 16% (Source: Norstat Research 2024). The other three portals are largely interchangeable. Of course, ViaBOVAG has the BOVAG label, Autotrack offers security, and Autoscout24 attracts a large, even international, buyer audience. All three are verticals competing primarily with each other.

Lead-to-Sale Conversion:

- Autotrack/Gaspedaal: 34.7%

- ViaBOVAG: 17.4%

- Autoscout24: 16.9%

- Marktplaats: 13.4%

Number of Leads (Phone, Email, WhatsApp) (Source: Walcu CRM):

- Marktplaats: 230 leads

- Autoscout24: 59 leads

- Autotrack/Gaspedaal: 29 leads

- ViaBOVAG: 23 leads

Sales Results:

- Marktplaats: 31 sales

- Autoscout24: 10 sales

- Autotrack/Gaspedaal: 8 sales

- ViaBOVAG: 4 sales

Cost per Sale:

- Autoscout24: €841

- ViaBOVAG: €291

- Marktplaats: €241

- Autotrack: €187

Given the budget-to-revenue ratio, the cost per sale at Autoscout24 is simply too high for us. Other car dealerships may have different experiences, and each must make its own decision. At Autoscout24, we advertised all used cars, five of which had Premium listings and AI Lead Alerts. These services ultimately increased our cost per sale.

When we presented these numbers to Autoscout24, explaining that the ROI was poor and asking for a lower price to remain a client, there was no response. We concluded that Autoscout24 currently adds no value for us. This might be different for other car dealerships and other channels, like Marktplaats.

From Four to Three Portals

Thus, we reduced from four to three portals. Marktplaats remains essential: we sell by far the most cars there. Although its conversion rate is lower, the number of units sold and associated cost per sale weigh more heavily in our KPIs. ViaBOVAG and Autotrack, as vertical players, generate leads and sales. Lead volumes should increase, but the cost per sale is acceptable.

Vehicle Listing Ads

Dropping one portal frees up funds to invest in Google Vehicle Listing Ads. We can now explore whether VLAs yield better results than Autoscout24 at current rates. Ultimately, VLA must deliver a cost per sale that aligns with our average transaction profit per car. Margins per transaction are too low to justify a high cost per sale. With the freed-up budget, we have ample room to make VLA a success.